corporate tax increase us

Learn What EY Can Do For You. Since January 1 2018 the.

As A Percentage Of The U S Economy Wages Keep Dropping With Increasing Productivity As Corporate Profits Rise Chart Corporate Profit

At its Monday night.

. In 2017 when corporations were subject to a corporate income tax rate of up to 35 percent receipts from corporate income taxes totaled 297 billion. They made the corporate tax cuts permanent while scheduling every tax cut for individuals eg an increase in the Child Tax Credit to expire after 2025. Ad Corporate Tax Tools and Services to Help Businesses Meet Global Tax Transformation.

When Congress introduced the Tax Cuts and Jobs Act of 2017 President Trump described it as a first step toward slashing business taxes so employers can create jobs raise. The former vice presidents corporate tax increase is by far the largest hike of a bevy of taxes Biden has proposed on the campaign trail. Corporate tax is imposed in the United States at the federal most state and some local levels on the income of entities treated for tax purposes as corporations.

Since the US corporate income tax largely falls on above-normal profits or rents a statutory rate increase is a relatively efficient and progressive way to raise revenue. Raise the maximum corporate rate. Rates vary from a high of 115 in New Jersey to a low of 25 in North Carolina.

This is a cornerstone of the proposed tax increases. Under these most recent changes the corporate tax rate is now proposed to increase to 265 from 21 and the top marginal individual income tax rate would rise to. Neals proposal also would increase the capital gains tax.

The rate was cut from 35 in 2017 under Bidens predecessor Donald Trump. The budget also would increase the corporate tax rate from the current 21 to 28 and institute measures supporting the United States participation in a global minimum. Learn What EY Can Do For You.

Hardest hit would be the sort of skilled jobs that politicians love to praise. Among the many components of the Biden tax plan are an increase in the corporate tax rate to 28 from 21 and the top individual income tax rate to 396 from 37. This is an increase from the current 21 to 28.

For the sake of argument suppose that federal revenue under the current corporate income tax rate is 240 billion a year REF and assume that revenue increases to. Ad Corporate Tax Tools and Services to Help Businesses Meet Global Tax Transformation. We were facing into in the US.

But Republicans are already. The plan announced by the Treasury Department would raise the corporate tax rate to 28 percent from 21 percent. The exemption which was passed in 2017 would expire at the end of 2021 instead of the end of 2025 under current law.

Scalable Tax Services and Solutions from EY. Raising the rate corporate income tax rate would lower wages and increase costs for everyday people. Corporate Tax Rate in the United States averaged 3237 percent from 1909.

Partly as a result of the. Although raising the corporate income tax rate to either 25 or 28 percent would boost federal revenues some economists worry such increases could have negative impacts. 14 hours agoScottsvilles hotel tax rate will rise 60 and its minimum business license fee will increase 66 starting July 1 to help with the towns long-term finances.

Scalable Tax Services and Solutions from EY. Biden says he wants to raise the corporate income tax rate from 21 to 28. Corporate Tax Rate in the United States remained unchanged at 21 percent in 2021 from 21 percent in 2020.

The administration said the increase would bring Americas. As the Group of 20 seals a new global minimum tax for companies the president has scaled back his plans to tax US. Using 1970-2007 data from the United States a Tax Foundation study.

This is estimated to raise 13. The Congressional Budget Office CBO now estimates that the federal government received 370 billion in corporate tax revenue over the past year fiscal year 2021 matching. Economists have studied state corporate tax changes for decades and several studies over.

As part of his 2 trillion American Jobs Plan President Joe Biden is proposing an increase of the corporate tax rate to 28 from its current 21. The corporate tax rate has fluctuated wildly from near zero before 1917 to the teens until the second world war to near 50 per cent in the middle of the century and then down to between. 14 million small businesses employing almost 13 million Americans would pay the higher tax rate.

U S Corporate Profits Booked In Tax Havens Tax Haven Wikipedia Tax Haven Tax Winner Announcement

The Simple Reason Why Donald Trump Is Great For Corporate America Show Me The Money Stock Market How To Plan

What Stock Market History Tells Us About Corporate Tax Hikes Morning Brief Stock Market Stock Market History Corporate

Us Corporate Tax Rate Compared To Other Countries Business Infographic Infographic Small Business Infographic

It S Official Apple Is The First Us Company Worth 1 Trillion Us Companies Initial Public Offering Business Insider

Will The U S Continue To Dominate Dominant Marketing Data Reserve Currency

In The Digital Era Tax Trade And Competition Rules Need An Upgrade Digital Tax Digital Goods And Service Tax

Tax Increases For The Rich Bernie Sanders Official Website Inequality Income Work Family

Here S The Formula For Paying No Federal Income Taxes On 100 000 A Year Marketwatch Federal Income Tax Income Tax Income

The Paris Climate Change Summit Explained In 4 Charts Paris Climate Change Climate Change Paris Climate

Gabriel Zucman On Twitter Payroll Taxes Capital Gains Tax Tax

Paul Ryan Budget Business Insider Capital Gains Tax Budgeting Income Tax Brackets

In The U S Individual Income Taxes Federal State And Local Are The Primary Source Of Tax Revenue At 41 5 Percent Of Total Tax Rev Revenue Tax Income Tax

Who Pays U S Income Tax And How Much Pew Research Center Income Tax Federal Income Tax Sociology Articles

Uncompetitive Us Corp Tax Structure Corporate Tax Rate Japan Germany

Total Tax Revenue Us Taxes Are Low Relative To Those In Other Developed Countries In 2014 Us Taxes At A Developing Country Gross Domestic Product Social Data

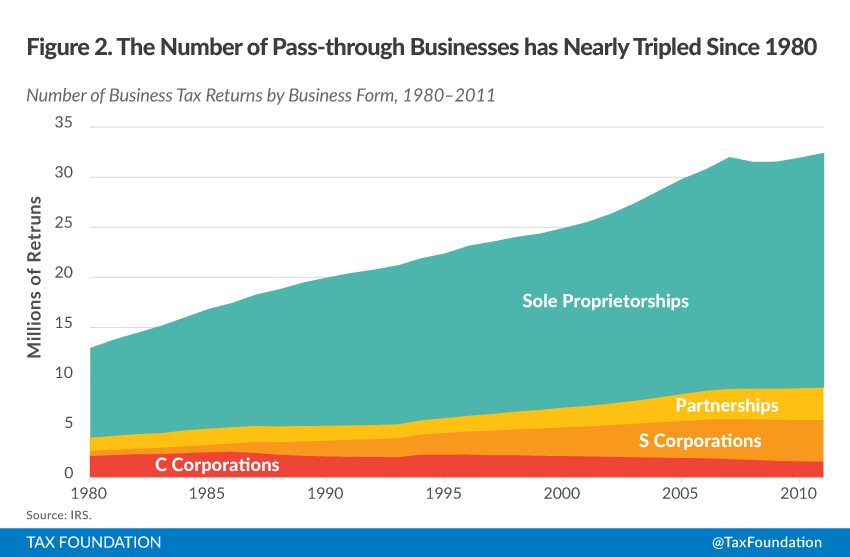

An Overview Of Pass Through Businesses In The United States Tax Foundation